Algeria’s future dairy industry looks bright

Algeria’s government is focused on modernising and expanding the dairy sector. Meanwhile, the country continues to be one of the leading global dairy powder importers. However, with recent reports of foreign investors throwing their nets, the future of the dairy industry looks to be brighter.

Algeria is one of the leading consumers of milk in North Africa. Current local fluid milk production is estimated to meet just over half of the annual 4.5 billion litres (4.5 mmt) of consumption, according to the recent USDA GAIN report. The report brings to the public eye the current and future/forecast consumption, production and import of milk and milk products. One may wonder why government programmes and policies to improve domestic production are falling short. Let’s find out.

Milk consumption

As noted, current local fluid milk production is estimated to meet just over half of the annual 4.5 billion litres (4.5 mmt) of consumption. The rest is fulfilled by imported milk powder. Algeria’s consumption in 2023 and 2024 is estimated at 4.3 mmt annually, since the government estimate does not separate consumption from stocks. As the strategy of the government of Algeria is to control and reduce imports of milk powder, the latter is trying to encourage consumers to favour fresh milk produced locally rather than reconstituted milk. With the implementation of the development programmes, the government gives incentives for the integration of fresh milk into the dairy processing industry.

Milk production

The overall strategy of the government of Algeria is to develop and improve domestic production and reduce imports for several sectors, including dairy. However, despite the success of some development programmes, Algeria still relies on imports for its needs. In 2022, the minister of Agriculture, Abdelhafid Henni, estimated local fluid milk production at 2.5 billion litres per year – equivalent to 2.5 mmt, while domestic market needs for fresh milk were estimated at 4.5 billion litres per year, or 4.5 mmt. Cow’s milk represents 70% of the domestic production. Other milk production comes from sheep and goats. Camel dairy production is marginal. However, the Ministry of Agriculture is encouraging camel and goat breeding in the Saharan areas to improve overall milk production.

Government programmes

In the past 20 years, the government has adopted various incentives to increase domestic milk production, implementing several programmes to expand herd size and productivity, including increasing access to artificial insemination, embryo transfer, and importation of pregnant heifers and dairy cattle.

In addition, the government provides more than 18 billion Algerian Dinars (US$129 million) in annual subsidy support for the local production of fresh milk. This amount of subsidy is mainly for dairy cattle breeders, milk collectors and dairy processors. The MOA also supports fodder production and irrigation as well as the acquisition of fodder seeds, the production of silage and wrapped fodder, as well as subsidies for the construction of stables and the acquisition of irrigation systems to produce fodder. However, despite programmes designed to increase milk production over the years, constraints remain in animal husbandry, feed and nutrition management. In addition, there is a need for improved genetics and a modern fresh milk collection system. Moreover, pasture area is reported inadequate to expand herd size.

Import of milk products

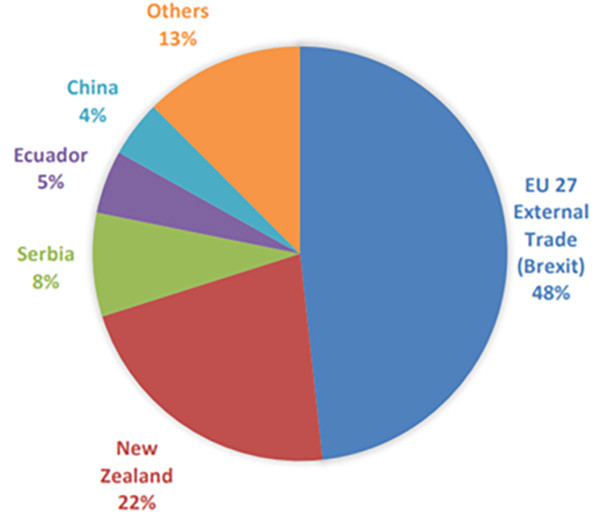

Figures from the Trade Data Monitor show that in 2022, Algeria’s milk powder imports increased compared to 2021. Algeria imported almost 419,000 mt of total dry milk powder. In 2023, Algeria’s total milk powder imports increased to 440,000 mt, which was 5% higher than 2022 imports of 419,000 mt. In 2024, it is forecast that imports will remain elevated.

The 2023 estimates and 2024 forecasts are driven by international prices that decreased by the end of 2022 and the downward trend that continued until September 2023. Higher imports are also driven by Algeria’s improved economic performance.

Algeria’s imports of both butter and cheese have been on a downward trend for the past 5 years due mainly to the measures implemented to control imports of food products as well as international prices that are on an upward trend. New Zealand remained the butter export leader with (56.2%) in 2022, despite seeing its total exports drop by 40%. It is believed that New Zealand’s changing price dynamics drove export fluctuations to Algeria.

Influence of investment on trade

Recent reports show there is great foreign investor interest in Algerian dairy production. In 2022, 2 large dairy producers from the Gulf – Qatar’s Baladna and Saudi Arabia’s Almarai – announced that they were considering launching dairy operations in Algeria. Recent reports show that the Qatar-based dairy company Baladna has signed an agreement with the Algerian Ministry of Agriculture and Rural Development to develop one of the world’s largest integrated agricultural projects aimed at producing approximately 1.7 billion litres of milk annually, meeting 50% of Algeria’s national demand for powdered milk.

These investments are expected to bring a new dimension to the country’s production and trade figures, bringing a possible shift to the market share of imported agricultural products.

According to the USDA Annual Exporter Guide report, of the total US agricultural exports to Algeria, consumer-oriented products represent 15% of the total US exports in 2023. Other reports show Irish dairy products at €100 million were shipped to the country in 2023 alone. The influence of new investor players in the dairy industry is expected to complement the current efforts to grow the country’s GDP. The World Bank estimated that Algeria’s GDP grew by 4.1% in 2023, though inflation reached over 9.3%. In 2024, the World Bank expects GDP growth to slow due to stagnant oil and agricultural output, before rebounding in 2025.

On the other hand, the IMF estimates the national economy at around US$200 billion. Overall, with the promising foreign investments, the future of one of the leading dairy powder importers inclines towards self-sufficiency.