How is Thailand coping with high dairy demand?

Demand for liquid milk in Thailand surged to new heights in recent years, leaving the country with a considerable deficit of home-produced dairy products.

As Thailand continues to prosper, its middle-class population is growing fast and with that, demand for dairy produce is increasing. Thailand is now ranked as the 12th largest dairy export market in the world. In fact, in 2022, global exports of dairy produce to Thailand exceeded 324,000 tonnes (worth over US$1.1 billion), with butter, whole milk powder and lactose being the top 3 imported commodities.

The surge in demand led to a number of foreign dairy processors setting up in Thailand to import milk and dairy products to fill the void. However, while the import business became rather lucrative, the situation today is somewhat different. Some of those same processors are now threatening to close down and move elsewhere in Asia.

Free trade agreements

When Thailand opened up free trade agreements with countries such as Australia and New Zealand, this suddenly meant that imports from Europe and the US were less competitive, which also meant that some dairy farms in Thailand closed as they, too, could not compete with the cheaper imports.

The Thailand-Australia Free Trade Agreement (TAFTA) came into force on 1 January 2005, and immediately cut tariffs on all dairy products. From 1 January 2020, the ASEAN-Australia-New Zealand Free Trade Area agreement replaced the TAFTA as the preferred agreement for exporting dairy products to Thailand. This covers all dairy products except liquid milk and skim milk powder. The TAFTA agreement remains the preferred agreement for these 2 products with special safeguard volume restrictions set to be phased out by 2025.

The majority of Thailand’s home-produced raw milk is sold as ready-to-drink milk. However, with established lucrative export markets for pasteurised and UHT milk, yogurt and butter, the country has to import some dairy produce, including whole milk powder, to satisfy these markets.

Thailand’s dairy numbers

The latest figures available for 2022 suggest there are 442,000 dairy cows in Thailand with an average milk production of 2,730 kg per year. The total milk production for 2022 was 1.2 million tonnes. There has been a steady increase in the number of cows and overall production since 2010 when there were 280,000 cows producing 0.9 million tonnes per year. However, the average yield per cow in 2022 is lower.

The average herd size in the country is just 20 cows as there are many smallholders with dairy cows. There was an increase in the number of dairy farms from 2016 to 2021, but spiralling costs of production have now forced many of these to quit. The figures also show there were 22,100 dairy farms in 2022, substantially fewer than the 24,300 in 2021, but still more than the 19,000 dairy farms in 2010.

Dairy feed and breed

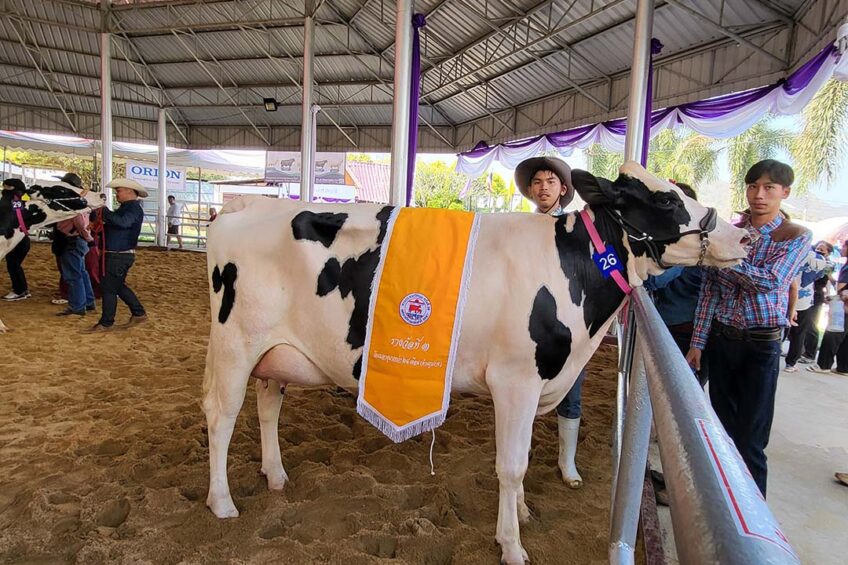

Typically, the cows are fed corn silage and hay, with small herds operating a grazing system. Holstein is the most common commercial dairy breed used in Thailand, but some farms also use Jersey and Brown Swiss genetics. Local breeds are also common and many of the cows are crossbred with Holstein. Thailand does produce some of its own cattle semen, but it does import genetics as well.

Outside influences such as the wars in Ukraine and Israel have also pushed up the cost of milk production in Thailand, putting pressure on farmers.

The milk price in 2021 was 18.45 baht (€0.48) per kg compared to 15.46 baht (€0.40) per kg back in 2010. The cost of production rose from 13.59 baht (€0.35) per kg in 2010 to 14.85 baht (€0.39) per kg in 2021. The milk price today is around 19.20 baht (€0.50) per kg.

Danish influence

Denmark has been very influential is establishing the dairy industry in Thailand, going back to the original Thai Denmark Dairy Farm which opened in 1962. In January 2022, Denmark and Thailand further strengthened this cooperation by signing a Memorandum of Understanding. As part of the MoU, together with the Danish Veterinary and Food Administration, the Danish Embassy in Bangkok aims to assist Thailand to become self-sufficient with milk and dairy products in a sustainable and climate-friendly way.

Henning Hoy Nygaard, Minister Councillor for Agriculture based at the Danish embassy in Bangkok, helps continue Denmark’s support for the dairy industry in Thailand. “Today, Thailand has a daily deficit of at least 100 tonnes of milk and the school milk programme alone takes one third of the fresh milk produced,” he said. “Denmark can provide new feed technology, genetics, farm management systems and better IT systems and data to help Thailand achieve more resource-efficient and sustainable dairy production. A Danish dairy cow produces on average more than 10,000 kg of milk per year, approximately 3 times more than a dairy cow of the same breed in Thailand.”

Danish genetics company VikingGenetics has also enjoyed a long partnership with the Thai dairy industry. It’s export manager Seppo Niskanen explains: “Denmark and Thailand have a long history in the dairy sector. More than 60 years ago there was no commercial milk production in Thailand and some Danish people wanted to develop it. In 1962, Denmark exported 39 red dairy cattle to Thailand, and about 50 more a year later. In this period, the cows were crossbred with local breeds and later with Holstein Friesians.”

He added: “Last year, the first VikingRed embryos and sexed semen doses were shipped to Thailand. There is huge interest in Red genetics in Thailand and we hope VikingGenetics can improve the milk production in the country with excellent genetics in the coming years.”

Sustainable dairying

One key area that the Thai dairy industry is trying to improve is sustainability and has already received some support for this. Last year, Alltech and the Dairy Farming Promotion Organization of Thailand (DPO) agreed to collaborate to create a model for nutrition innovation and sustainable dairy farming.

Alltech has enjoyed a fruitful working relationship in Thailand for over 25 years and now wants to leverage global expertise and technologies to sustainably develop and expand dairy and beef cattle production in Thailand.

The collaboration aims to enhance production efficiency, milk quality, animal welfare and economic benefits in Thailand’s dairy industry. Alltech and the DPO are working together to assist farmers in developing appropriate knowledge and utilising relevant technologies, services and management practices for sustainable dairy and beef cattle production. This will improve dairy cow performance as well as the quality and quantity of milk produced.

The DPO is a Thai state enterprise under the oversight of the Ministry of Agriculture and Cooperatives. It is best known as the manufacturer of the Thai Denmark brand of dairy products. It is committed to promoting dairy farming and communicating knowledge of dairy industry affairs in Thailand.